Young Coloradans are ready to make the wealthy pay their fair share.

With billions of dollars in budget cuts at the federal and state levels, there is no better time than now to stand up and advocate for where we spend our money. We have the power to insulate Colorado from the impending harm, and the biggest step to achieving this is reforming our tax code at the ballot box in 2026.

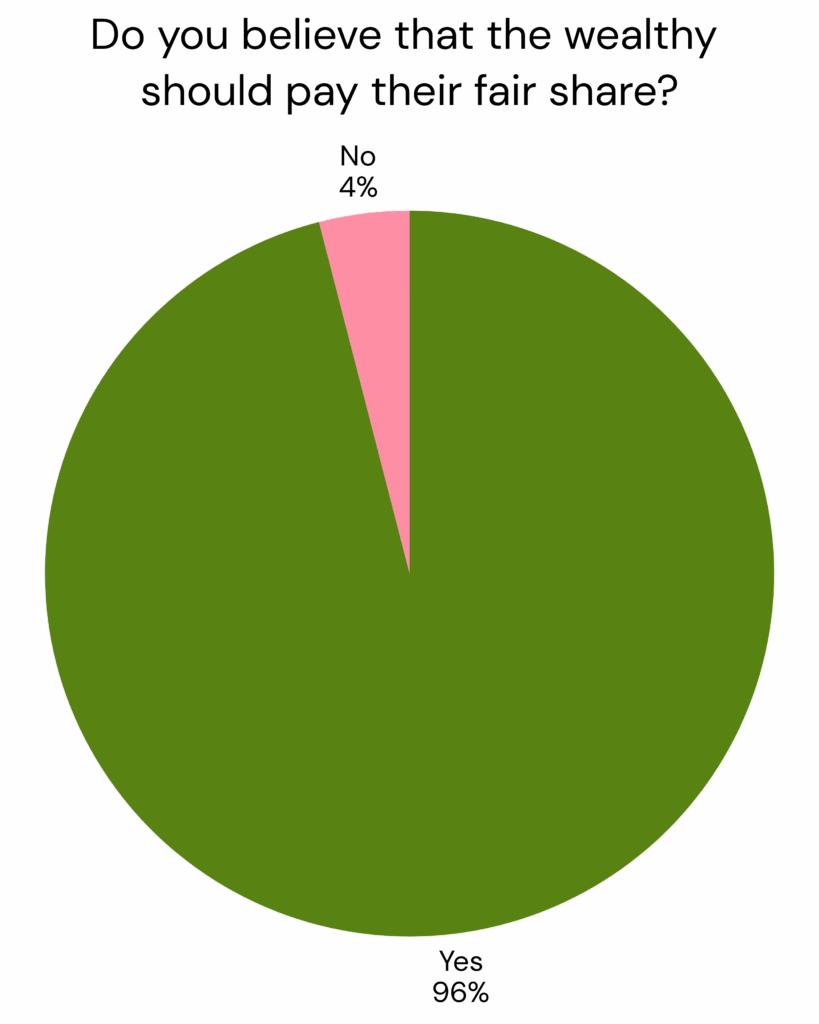

From conversations at our community tables throughout the Front Range to talking to our base through phone calls and texts, we’ve spent our summer working to understand where young people in Colorado currently stand when it comes to taxes. Through a 2-week phone survey with the help of OpenAnswer, we found that 96% of the young Coloradans we spoke with believe the wealthy should pay their fair share.

Currently, our state has a regressive income tax, or a flat income tax, where the middle class pays a third more of their income in taxes than the top 5 percent of earners. This provision of the Taxpayer Bill of Rights (TABOR, a.k.a. Tired and Broke on Repeat) benefits the wealthy while placing a disproportionate burden on everyday people

We dream of a system that would cut taxes for the 99% and for top earners, we want tax rates to increase as their income increases. This is called a graduated, or progressive, income tax.

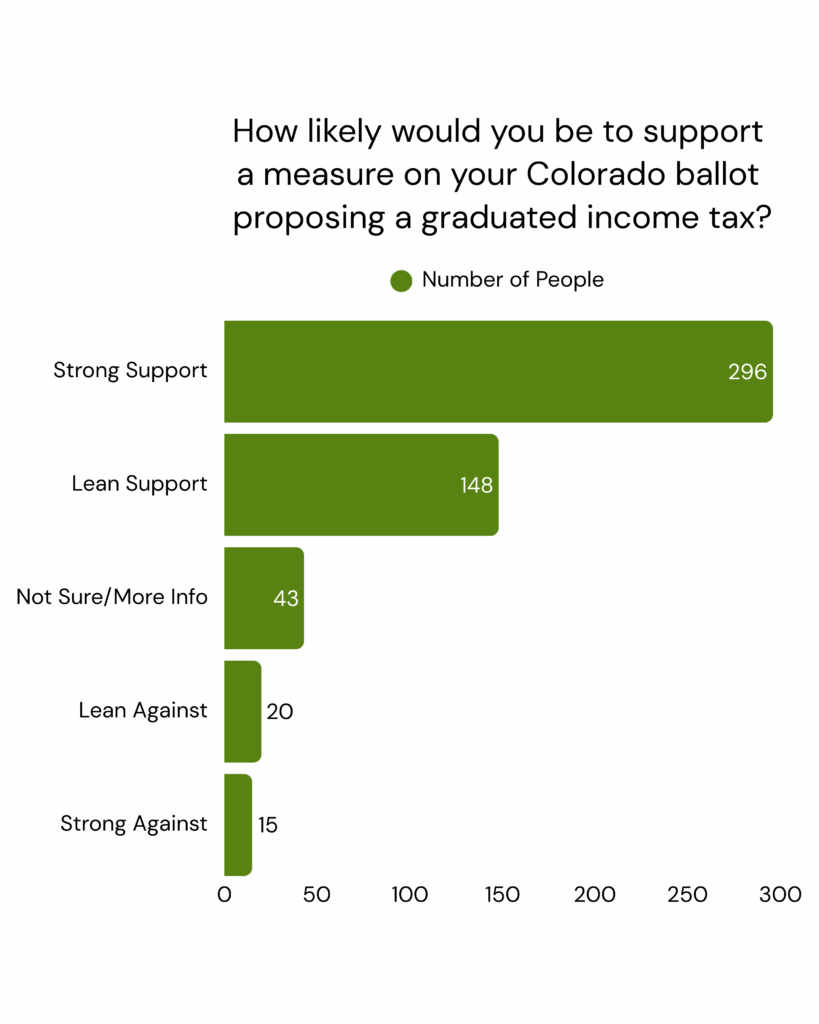

Through our survey, we were able to connect with over 500 young Coloradans, ages 18-34, and gain valuable, measurable insights into young people’s perceptions on the topic.

We then asked folks if they were familiar with the idea of a progressive income tax, without providing a definition. For the people who said no–a little over 38%–we explained what a progressive income tax does.

We then asked all respondents to rank how likely they would support a progressive income tax proposal in Colorado on a scale of 1-5, where one indicated strong support and five indicated strong opposition. Results showed that over 85% of respondents either strongly or likely would support a ballot measure. Additionally, 78% of those who initially didn’t know what a progressive income tax was said they were likely to support one after having the idea explained to them.

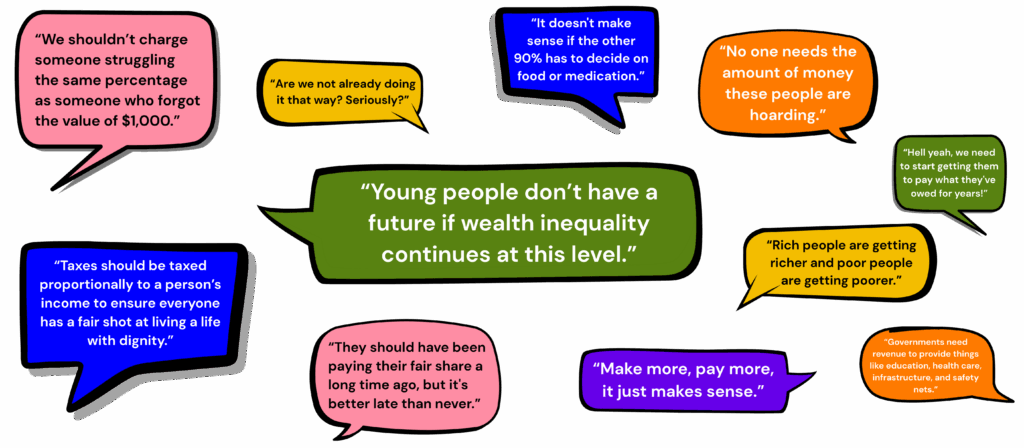

The young people in our survey were then given the opportunity to elaborate on why the number they chose felt right for them. Because of the time and thoughtfulness OpenAnswer’s team spent with each individual over the phone, we were able to create a safe environment where respondents felt comfortable opening up and sharing different aspects of their personal lives and experiences.

From sentiments highlighting the reality of our country’s wealth disparity to the quality of our neighborhoods and cities, their main consensus was that tax policy is an issue of fairness and equity. People connected how the wealthy paying their fair share in taxes could result in being able to continue staying on Medicaid and how a well-structured, proportional income tax policy invests in the common good.

These responses show us some common themes in young people’s stances:

- Our families and communities deserve to be well-resourced and taxes can invest in the common good,

- Policies should be equitable and rooted in the lived experience of people,

- Taxes are crucial to funding programs that are a part of people’s everyday lives,

- Low-income and working-class people are feeling the pressures of the ever-rising cost of living and the cutting of essential state and federal programs, and

- Wealth hoarding and wealth inequality stand in the way of people being able to thrive.

The reality of our state’s economic situation is not going unnoticed nor unfelt. What was inspiring about the results of these conversations is that while young people named the ways they feel the negative impacts of our current economic state, it didn’t stop them from being able to envision what an equitable, well-funded state could look like.